That is, if President Obama can get Congress to swiftly do the very first thing, the immediate top priority: pass legislation guaranteeing tax stability at current levels for the Middle Class, so that markets won't panic on January first. All else can be thrashed out in an "outline" for the next Congress to finalize by March.

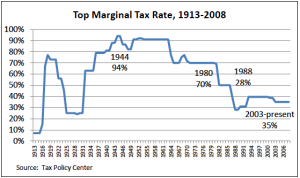

That is, if Speaker Boehner can herd enough Republicans into accepting more revenue from the rich. And if their masters on-high grumble but accept what the election's Super-Pac Collapse showed, that the oligarchic putsch is waning. With tax rates near their lowest in 70 years and with Federal revenue as a share of GDP at its lowest since the end of WWII, it's time to ignore those imbeciles maniacally preaching hatred of our own government, blaming it for all things. And time for the uber-rich to accept what the First Estate foolishly refused in 1789 France - that it's time to pay a bit for being members of a civilization.

That is, if Speaker Boehner can herd enough Republicans into accepting more revenue from the rich. And if their masters on-high grumble but accept what the election's Super-Pac Collapse showed, that the oligarchic putsch is waning. With tax rates near their lowest in 70 years and with Federal revenue as a share of GDP at its lowest since the end of WWII, it's time to ignore those imbeciles maniacally preaching hatred of our own government, blaming it for all things. And time for the uber-rich to accept what the First Estate foolishly refused in 1789 France - that it's time to pay a bit for being members of a civilization.

Oh, but liberals will have to give, as well! This can all happen if the President delivers sincere counter moves on entitlements: the easiest being simply to tell Americans the truth. "Hey, you live a lot longer than your parents did, so you can work just a tad longer... and 70 is the new 50 anyway." If he does that, in exchange for an end to Bushite supply-side voodoo largesse for aristocrats, then our children will be saved at a single stroke.

The rest of the deficit? Well, as I explained elsewhere, half of the causes of our current mess should dissipate, once the other half come under control, and now that we are safe from our house being ruined again by the same fools who bulldozed it over a cliff from 2001 to 2009.

The rest of the deficit? Well, as I explained elsewhere, half of the causes of our current mess should dissipate, once the other half come under control, and now that we are safe from our house being ruined again by the same fools who bulldozed it over a cliff from 2001 to 2009.

== The Role of the Tax Code in All This ==

Now, Let's be clear; the deal that emerges may have some twists to it. Republicans will be seeking a face-saving way to increase inflows from the rich -- an approach validated not only by the electorate but also a report from the Congressional Research Service declaring that Supply Side mythology is, was, and always will be hokum. That incantation worked far too long, hypnotizing a generation on the right, but it's over and good riddance. (Adam Smith himself said that most aristocrats do not invest any sudden largesse into innovative capital. That was a fantasy.)

While admitting the inevitable, GOP politicians are eager not to explicitly violate their "no new taxes" pledge to Grover Norquist, who still has some clout despite his star fading, at long last. Desperate for a fig leaf, Republican legislators tout a semantic distinction between "augmenting revenues" and "raising tax rates."

The leading proposal on the table right now appears to be eliminating the ability of the rich to evade taxes through deductions, a suggestion offered briefly, during the many policy gyres of GOP presidential nominee Mitt Romney. By eliminating a wide range of deductions, or else capping all deductions at - say - $25,000 per person/year, a large flow of revenue could be tapped while allowing the actual marginal rates of income taxation to remain at Bush Cut levels. (Not enough, according to Treasury Secretary Geithner, but a good start.)

Another approach would be to raise - or even eliminate - the regressive cap on the payroll tax that feeds social security and Medicare. If that were also applied to capital gains and dividend income, so much new revenue would be generated that the rate of the payroll tax would have to be reduced, lest serious damage occur! (That mere fact shows just how skewed our values have become - that honest work is taxed harsher than what Adam Smith derided as "rent-seeking" - the lowest form of economic activity, according to Smith.)

Another approach would be to raise - or even eliminate - the regressive cap on the payroll tax that feeds social security and Medicare. If that were also applied to capital gains and dividend income, so much new revenue would be generated that the rate of the payroll tax would have to be reduced, lest serious damage occur! (That mere fact shows just how skewed our values have become - that honest work is taxed harsher than what Adam Smith derided as "rent-seeking" - the lowest form of economic activity, according to Smith.)

Any of these approaches might work. I am partial to the elimination of whole deductions if only for one reason, that it would contribute to another long term project, simplifying the Tax Code.

As a matter of fact, there is a way to do that, and minimize the amount of kicking or screaming or obstruction. It seems worth doing on its own merits! Some of you have read my proposal before and I've been encouraged to keep pushing by folks who work in this very field. It ought to work.

== The Goal of Simplification ==

Just after being elected in 2008, President Obama said he would seek a reform of the U.S. tax code, calling the current system is a "10,000-page monstrosity." But that promise has been made by others before and every proposed change ran up against a wall. Every "simplification" would gore someone's ox. The more code-trimming you do, the more people will scream.

Just after being elected in 2008, President Obama said he would seek a reform of the U.S. tax code, calling the current system is a "10,000-page monstrosity." But that promise has been made by others before and every proposed change ran up against a wall. Every "simplification" would gore someone's ox. The more code-trimming you do, the more people will scream.

I know a simple way around this. The sheer bulk of the tax code -- its complexity, in numbers of rules, words or exceptions -- could be trimmed without much political pain or obstructionism! Because the method is designed to be mostly politically neutral. It does not aim at some utopian fantasy (like the Flat Taxers rave about.) It gores only a few sacred cows. It would be cheap and easy to implement. Only accountants should hate it for the effects on their lucrative business. Yet, to the best of my knowledge, this method has never been tried, alas.

(Note: an earlier version of this article ran some years ago and is still available at my web site.)

== How can I promise such a thing? ==

There is nothing on Earth like the U.S. tax code, an extremely complex system that no one understands well. But unique in that it's complexity is perfectly replicated by the MATHEMATICAL MODEL of the system. Because the mathematical model is the system.

One could put the entire US tax code into a spare computer somewhere, try a myriad inputs and tweak every parameter to see how outputs change. There are agencies who already do this, daily, in response to congressional queries. Alterations of the model must be tested under a wide range of boundary conditions (sample taxpayers). But if you are thorough, the results of the model will be the results of the system.

Now. I'm told (by people who know about such things) that it should be easy enough to create a program that will take the tax code and cybernetically experiment with zeroing-out dozens, hundreds of provisions while sliding others upward and then showing, on a spreadsheet, how these simplifications would affect, say, one-hundred representative types of taxpayers. As I've said, this is done all the time. A member of Congress has some particular tax breaks she despises and asks the CBO for figures on the effect, should those breaks be eliminated. Alas, as soon as word gets out, her proposal faces a firestorm from powerful interests fighting like hell to keep from losing millions.

Hence, although American corn-ahol subsidies propel high food prices and hunger around the world while doing little for the environment, nothing is done to end the wasteful program that costs more net energy than it delivers. There are thousands of other special interest groups that each wish the budget to be balanced... on someone else's back. How to get past this?

A key innovation: program in boundary conditions to the experiment, so there are no losers.

Let the program seek and find the simplest version of a refined tax code that leaves all 100 taxpayer clades largely unhurt. If one group loses a favorite tax dodge, the system would seek a rebalancing of others to compensate. No mere human being could accomplish this, but I have been assured by experts that a computer could do it in a snap.

Let the program seek and find the simplest version of a refined tax code that leaves all 100 taxpayer clades largely unhurt. If one group loses a favorite tax dodge, the system would seek a rebalancing of others to compensate. No mere human being could accomplish this, but I have been assured by experts that a computer could do it in a snap.

Here's the key point: If such an iterative search finds a new, much simpler tax structure that leaves none of the 100 groups more than 5% worse off than they currently are, then who is going to scream?

Oh, well, I suppose a lot of people will. Cheaters will holler of course, and those who benefit from the cloud of obscurity allowed by an overly complex tax code. Even if farmers are guaranteed adjustments in other areas, they will reflexively protest over the end of Roosevelt-era subsidies. In fact, everybody will complain! But...

...but a lot of the HEAT will be taken out of their complaints, if they see that their own bottom line is completely unchanged. And that is the secret. To remove enough heat so that people can calmly re-assess, negotiate, and accept pragmatic simplification that's good for all.

== Will "no-losers" really leave everyone unaffected? ==

Nope. One hundred sample-type American taxpayers won't cover everyone, especially at the upper end. Some in the aristocracy have tax laws that were enacted specifically to benefit them! They will hit the roof. But if enough of the rich are included in "no-losers" they might tip the balance, canceling out the final obstructors, for the sake of a new simplicity. And a new patriotism.

Will this method solve all tax-related problems? Of course not! Complexity is not the only thing wrong with the Tax Code. After simplification must come some genuine tax policy shifts that do advantage some and disadvantage others. Like all of you, I have my favorite injustices I'd love to see redressed, behaviors disincentivized, business ventures stimulated... and so on.

But, by starting with "no-losers," you can use politically neutral optimization routines to find a much simpler system. Industrial concerns like auto companies already do this sort of thing, trimming and slimming machinery to use the fewest parts, while achieving similar output. We could similarly refine the machine that is the Tax Code. Then, and only then, will it make sense to argue about steering the vehicle in new directions.

Sign the #NoLosersTax petition

to have the CBO perform an open, computerized, impartial mathematical

model of the tax code, with 100-500 example tax payers, and zeroing out

provisions, or changing credits and exemptions, and establishing

boundary conditions, the most paramount being "No Losers!", to attempt

to find a simplified tax code that would not impact any tax payer (below

$200,000/yr earnings) more than 5%. Then make the results public.

Sign the #NoLosersTax petition

to have the CBO perform an open, computerized, impartial mathematical

model of the tax code, with 100-500 example tax payers, and zeroing out

provisions, or changing credits and exemptions, and establishing

boundary conditions, the most paramount being "No Losers!", to attempt

to find a simplified tax code that would not impact any tax payer (below

$200,000/yr earnings) more than 5%. Then make the results public.

Sign the #NoLosersTax petition

to have the CBO perform an open, computerized, impartial mathematical

model of the tax code, with 100-500 example tax payers, and zeroing out

provisions, or changing credits and exemptions, and establishing

boundary conditions, the most paramount being "No Losers!", to attempt

to find a simplified tax code that would not impact any tax payer (below

$200,000/yr earnings) more than 5%. Then make the results public.

Sign the #NoLosersTax petition

to have the CBO perform an open, computerized, impartial mathematical

model of the tax code, with 100-500 example tax payers, and zeroing out

provisions, or changing credits and exemptions, and establishing

boundary conditions, the most paramount being "No Losers!", to attempt

to find a simplified tax code that would not impact any tax payer (below

$200,000/yr earnings) more than 5%. Then make the results public.

124 comments:

70 is *not* the new 50. Maybe if you're a writer, but if you actually do physical work for a living this is a terrible proposal.

In addition the increased size of the work force will hurt unemployment and put downward pressure on wages.

And if you increase the medicare eligibility age, you make the system less sound, because the relatively younger people in the system help balance out the older people who need more health care.

Unknown is quite correct. 70 is more likely the new 60. And while you might be more physically fit in this day and age in older age than half a century ago... increasing the retirement age runs into the problem of discrimination against older job seekers. Companies seek to reduce costs by eliminating non-executive employees who've the longest tenure, due to the fact they've gotten the most pay increases over time (in theory).

Other companies are reluctant to hire older workers because they expect those "more experienced" workers to want more money. This is a serious problem that is currently impacting a number of people in their 50s and 60s who lost their job due to the end of Bushalot when Obama drove his spear through the heart of King George and his loyal minion (and heir) McCain.

Rob H.

In the tech industry, age discrimination makes me worry that I'll even last to 65. My father-in-law, uncle and step-father all ended up retired in their late fifties because of this.

Steveb:

In the tech industry, age discrimination makes me worry that I'll even last to 65. My father-in-law, uncle and step-father all ended up retired in their late fifties because of this.

My fear exactly!

I survived my own outsourcing by accepting my old job for the outsourcing company, but they're only obligated to keep me on for two years. Then at age 53, I'll get to compete with college students and inhabitants of "low-wage geography" for tech jobs.

If I wasn't married with a kid, I'd be so ready to retire now. And no, I wouldn't demand social security at age 53. Heck, all I'd need is a decently-heated apartment, food, and comic books, and I'd be content. Again, if I weren't married with a kid, I'd have saved enough money to support that lifestyle for many years by now.

BUT, the dark mirror to that "ambition" is that I'd be forced to forego health insurance, which means I'd be happy as a pig in slop as long as I stayed healthy, but once I developed an expensive, painful medical condition, I'd be thinking about how to painlessly depart this vale of tears.

Dr Brin (somewhat rightly) denounces marijuana as an "ambition killing" drug, but how much more "ambition killing" is the certain knowledge that everything one has spent one's life working for can be erased by one extended hospital visit?

(Sorry for today's mood. 'Twill pass, 'twill pass.)

Anonymous, that's an awfully big tar brush you've got there. What, specifically, do you have a beef with, and do you have an alternative? Unless you are being amusingly self-referential...

TheMadLibrarian

rmityonl 49: Alternative to triclosan

I have my doubts that the current administration will do anything meaningful regards entitlements.

If anything they are exapanding apace.

For an interesting stat to watch consider number of workers collecting disability. The ratio of same to active workers is at an all time high and appears to be rising.

But as I advised you all in the event of a Romney victory, I am wishing the best for President Obama. I will not oppose any reasonable proposals.

Tacitus

TheMadLibrarian:

Unless you are being amusingly self-referential...

I caught that as well. :)

Tacitus2:

I have my doubts that the current administration will do anything meaningful regards entitlements.

If anything they are exapanding apace.

One might characterize that as something meaningful.

:)

Seriously, I know what you meant, but for two years now have been disagreeing with you about the need to cut entitilements and the economic benefits of doing so. In some ways, our particular assumptions are so different that it's difficult to converse on the subject with a common vocabulary. I don't despise you for the position you hold, but I think you are mistaken.

Maybe I'm just getting old. In my teens and twenties, I'd probably be more open to the notion that if only I could put in the work hours to "get mine", no one else should have a claim on those rewards. I first read Ayn Rand when I was in my thirties, and while I didn't become a starry-eyed Objectivist, I did see the appeal.

But as someone passing middle-age, I'm more conscious of slowing down--of being tired after a 10-hour day or even an 8-hour day. Of wanting to say "Hey, I earned some rest in my decades of all-hours on-call support work", and resenting like hell those who read that attitude as me wanting to mooch off the work of others.

Wanting a good night's sleep, or a weekend off, or a non-working vacation is not "socialism". In fact, in my adult lifetime, that was part of the American Dream.

And I realize I've gone off the rails of actually debating your point several paragraphs ago.

The problem is, industry wants everything and wants to give nothing. Thus employees are expected to sacrifice their health and family but the company has every right to say "screw you" and let the employees go on the drop of a hat. The irony is that my very Republican friend is encountering this very problem with the current CEO of his company renowned for his liquidation skills... and his having screwed over almost every single union in the company in an effort to help lessen costs. One union resisted... and is now striking. And in all likelihood this one union will bring down the company and liquidation will start up full-time (it's difficult for a company that sells bread and pastries to stay in business when the baker's union has said "hell no!" and refuses to work).

My friend doesn't like the benefits rich people get. He feels they should pay more taxes and shouldn't get away with everything they do. But he feels Democrats will give away everything to "people who want stuff" and who lack a work ethic. In short, he believes Democrats are incapable of change (admittedly, he lives in Massachusetts where this may be the case) and considers Republicans, even now, the Lesser Evil.

He has a point. Entitlements are going too far. We need to start giving less... or accept that if we expand one entitlement (health care), other entitlements need to be reduced. And hell, if Obamacare had ONLY passed legislation disallowing discrimination against people for preexisting conditions (or astronomical overcharging for those conditions), then it would have been accepted happily by even Republicans. It just went too far.

So. We need to look at entitlements and determine what can be cut, where there is waste which can be eliminated, and what needs to be strengthened.

Though I still think older people should be protected from job discrimination by law. And I don't think Republicans would be able to resist a simple bill that stated just that one point and included legislation not allowing for riders (or stating "any riders will be countered by a +50% tax on all property owned by rich people which will never go into effect if no riders are added").

Rob H.

LarryHart

No, I understand your point. I am a few years older than you and typically do 12 hour shifts. Them night shifts are getting wicked on me.

As we get along a bit in age it is appropriate to slow down.

I am going to do a longer post on the increase in disability status. You could make all kinds of theories off of it.

But for good or ill, once a worker enters the disability ranks he or she is effectively done, at least in the official economy. With the baby boom demographic bulge we already have a challenge regards numbers of workers per retiree, and shifting folks from worker to retired status early will only make it more challenging.

A complicated issue, sure, so not one to dig into here too much.

If I wanted to work until I tipped over I think I could, our medical system is so goofed up that both primary care and ER are understaffed.

But for me this is not appealing. In a few years I'm off to new adventures.

Tacitus

Has anyone got actual figures on "entitlements" and what percentage of GDP they represent now, how that compares with US history and with other developed countries?

I put "entitlements" in quotes becasue I'm unsure whether a contributory scheme such as social Security should be included in the defintion of entitlements.

Social Security is an entitlement. But only insofar that people can get Social Security benefits without putting into it or get more from it than they put into it in terms of disability and related issues.

Of course, Social Security benefits for disabilities and the like allow people to live below the poverty line, but to some people that's still too much for a "leech" (and I'm reminded of an old Playboy cartoon with an anti-abortion mother who turns pro-abortion (in protesting) the moment she finds her daughter is pregnant - likewise, anti-entitlement people become pro-entitlement the moment they or their family needs that entitlement - or at least they're pro THEIR getting the entitlement).

Rob H.

Hand the tax code problem to Nate Silver and let him tell us what his computers did.

Unknown,,, yes there could be rules helping ease people over 60 years old into mild styles of employment. Work rules. Health tests. even a 30 hour week.

But you are the unrealistic person. Our ancestors did not get "retirement". Subsidizing as much as 30 years of healthy, pensioned indolence is a lot more than we - or any society - can afford. And gainfully employed people lead to MORE other people being employed, not less. You are prescribing European employment methods and that is NOT the thing we should copy from Europe!

Their health care system? Yes. Their employment and pension and retirement policies? Insanity!

Larryhart, you at least bothered to argue, instead of just snarking from a rigid partisan position. Not one of the people who came before you offered even a slight suggestion how we are to deal with the explosion in entitlements that we cannot afford, by any means in ADDITION to taxing the rich and ending the damned wars. I want those things. But unlike those fools, I also admit there's going to have to be some give from the other side, as well.

Where will you cut? Education? Research? Health? Those are investments in our future. It is blatantly obvious that if everybody is living much longer, healthy people can work a little longer. Jesus, where do YOU draw a line? What if lifespans expand to 1000 years? Will we still retire at 65? Why not emulate those European countries that put it at 55? What ever happened to the assumption, in most sane societies, that the children are far, far more important than we old farts are?

Hey, want that thirty hour week and an ease-in phase for retirement? Want a program to "employ" folks 62 to 70 in schools as mentors? I'll listen to all sorts of ways. But whining for a right to ride on our kids' shoulders for decades and decades of indolence that our ancestors never got? Sorry. That right is my lowest priority to preserve.

===

And I note no one comments on the TOPIC of this posting!

What am I, chopped liver? Pose the tax problem to Nate Silver and see what he says!

In 5 minutes I will be live on Huffington Post! Tune in via this link (I think):

http://live.huffingtonpost.com/r/segment/sci-fi-political/50a06c402b8c2a65eb00070e

Second Term Scandal?

I've said something like this before, so I'll keep it short this time. I'd like to see a tax on liquid assets equal to the income tax rate on assets greater than some multiple of an annual year's operating cost plus the value of current capital assets. So, you don't get taxed on your capital investments, but you don't get to sit on a pile of low velocity cash and cash equivalents, without paying for it.

Additionally, do away with the corporate income tax, and tax capital gains and dividends at income tax rates.

Regards

Ouch, I'm not used to pissing off our host. Then again, I was in a pissy mood myself today, so who am I to complain?

But in fairness to myself, I was not arguing for Social Security for myself at 53. I specifically said that I daydreamed of accumulating enough savings from a stressful job in order to finance my own retirement.

The point that I perhaps didn't make clear is that, while it's possible to do that for money, it is not possible to do so for health coverage. Most Americans get their coverage from an employer, and continued employment is a condition of eligibility. You can't "save it up" for later use.

So my wish is not for decades of unearned cash to live high off of, but for universal health coverage of some sort so that it's possible to be between jobs without literally risking one's life.

Robert:

Social Security is an entitlement. But only insofar that people can get Social Security benefits without putting into it or get more from it than they put into it in terms of disability and related issues.

"Entitlement" has become a dirty word, but it can be taken two ways. Do you consider yourself entitled to something you didn't earn? Or is it something you really are entitled to by virtue of paying into the system.

If you think of Social Security as insurance rather than as a version of an IRA, it makes more sense.

likewise, anti-entitlement people become pro-entitlement the moment they or their family needs that entitlement - or at least they're pro THEIR getting the entitlement).

Ayn Rand certainly took Medicare when she needed it, on the grounds that a writer didn't earn enough money to pay for her cancer treatments. So you know, swearing never to ask others to live for her sake wasn't all it was cracked up to be.

Hans, your proposal makes a lot of sense, at first sight.

LarryHart no sweat.

And I agree that the Republicans' Health Care Plan... now called Obamacare, actually SUCKS, though it is all we could get and improves the lives of 1/3 of americans.

Google has created a visualisation of the 100,000 stars nearest to the solar system, based on actual astronomical data. You can zoom in all the way to the solar system to see how small Neptune's orbit is relative to the Oort Cloud, or zoom right out to see how puny 100,000 stars is in just our quarter of the Milky Way galaxy.

Intended for Chrome, but works... haltingly... in Firefox on my 5 year old rig.

http://workshop.chromeexperiments.com/stars/

David,

Re: "No Losers" tax reform - addressing complaints.

If the model is on a computer in order to create the simplification, it seems that you could create a public facing version that would allow individuals to plug in their details and see their potential new after-tax income and tax-paid. As well as show them the forms they won't have to fill out, or programs they don't have to apply for, and show them the much simpler tax form they'll fill out each year. (And indeed, this demo system would serve as the basis for a new filing system.) One the criteria for the reform-shuffle should be to have a system that requires as little paper-work from ordinary tax-payers as possible, allowing a single-piece-of-paper (or online equivalent) tax filing for 90% of tax payers, 2 pages for 90% of the rest.

That might help assuage some of the fear/uncertainty/doubt manufactured by reform opponents and the click-chasing media.

Hans,

"I'd like to see a tax on liquid assets equal to the income tax rate on assets greater than some multiple of an annual year's operating cost plus the value of current capital assets."

Can you define "operating cost" in this context. I can't see what you're actually asking for.

David,

"70 is the new 50 anyway."

Coincidentally, Krugman just wrote about this. The gains in life expectancy are entirely in the top 50% by wealth. The bottom 50% has had static life-expectancy figures for at least the last 20 years. Since the top 50% generally won't need, or qualify for, pensions/medicare/etc, then there has been no improvement in life-expectancy amongst the people who actually need government assistance. Similarly the bottom 50% are more likely to do the physical work that causes cumulative damage to the joints that Dr Tacitus and friends can't yet heal. (Come on science! Stem cells, epigenetics, something! Deliver a god damned product.)

"Subsidizing as much as 30 years of healthy, pensioned indolence"

Life expectancy at 65, for the bottom 50%, is 15 years. Much of that will be in poor health. Only the rich and lucky get 30 years of health after 65.

Using my parents as an example: in my opinion, they barely made it to 65. Their health just wasn't up to continuing. Another 5 years would have killed them. They are not "indolent", they can't do the things they dreamed about, even the simple things they can afford, because they can't travel long distances, can't walk much, can't risk being too far away from medical care. If anything, they seem trapped in their home. That's their reward for working every year of their adult (and much of their teen) lives. It's just cruel. People shouldn't be forced to work until they are too broken to continue. For fucks sake, David, things should be getting better. We shouldn't be going backwards.

And my parents are not unusual. I see the same pattern repeated amongst their peers. Those last few years of work seem to be the most damaging, the most crippling. And it means they hit retirement unable to do normal things. In my opinion, for the sort of people who end up on government pensions, the retirement age should be lowered to 60. Maybe even a partial pension kicking in at 55 as a wage subsidy, allowing job-sharing semi-retirement for participating industries. This lets the older workers switch to half days, or half years, or move to training for the younger workers, or to have two older workers doing one-job's-worth of work between them, at no additional cost to the employer. That reduces the crippling damage caused by their final work years. Things should be getting better. Otherwise, what the hell are we doing all this for?

Have a look at US income growth over the last 20 years, across the middle and lower brackets. Those people who have already sacrificed. You don't betray these people again so you can make some Faustian bargain with the psychopathic Randroid billionaires. Want to lower the debt? Pay your damn taxes.

[PS. This is the shorter, walked away and calmed down, edited version. This is the most disappointed I've been in you. You never before struck me as a "kick down, kiss up" type.]

Liberals need to join the flat tax bandwagon. Seriously. The result is progressive if:

1. You merge payroll taxes into the income tax.

2. Treat capital gains and inheritances as ordinary income.

3. Replace most deductions and most federal welfare with a citizen dividend.

I have run some numbers here.

http://www.freemoneyforall.org/howMuch/flatTaxPrebate.php

Congress and the executive have access to better numbers, of course.

Geez are we playing political musical chairs here? Carl M, our libertarian, is definitely proving he's no tool of the oligarchy with his suggestions to:

1. You merge payroll taxes into the income tax.

2. Treat capital gains and inheritances as ordinary income.

3. Replace most deductions and most federal welfare with a citizen dividend.

All of which sounds fine... tho I still think you're gonna need some progressivity. What all this would mean is that it can be very shallow. But we need it IN PRINCIPLE in case oligarchy gets way out of hand...

...tho for that we might recourse to the one sane thing Donald Trump ever said. He called for a once-per-generation... or maybe once-per-decade WEALTH TAX. Kind of like the biblical Jubilee, it would flatten things to keep em competitive... then let capitalism run semi-wild for a while.

And yes, Pal451, now that the lection is over and the horrific oligarch putsch has been beaten back, I am showing some of my libertarian and even some conservative side...

...and you're surprised??? You though I was just CLAIMING to have such a side, for balance cred? Occasional easy shots as some idiot leftists and that's that?

Sorry. I worked harder than almost anyone you know to help Obama defeat the oligarchs, and you can expect more from me. But I will also point at things that make liberals uncomfortable. And entitlements are just gonna have to budge.

Sure, you convinced me! There ought to be some health-based options for easing old-timers into gentle lives when they need it, and some need it younger than others. And poverty may correlate. Fine. Show me your plan. I offered one... letting the employment after 65 be 25 hours a week mentoring and tutoring in schools, for example.

What I despise is what the Europeans have done, defining work as BAD and retirement as an unalloyed right to roam about doing whims for decades. And I know lots of Americans who do that too. And sorry, that is not what all our ancestors did. They stayed useful till infirmity or dotage stopped them, because our job is to serve the next generation, whatever it takes.

We live on, exactly to the degree that they remember that we were there for them.

Taxes

UK and NZ both have much simpler taxes - 80% of taxpayers never fill out a tax form

NZ has no initial exemption - first dollar you earn - it's taxed!

Both still have complications so that the rich can reduce their taxes

Life Expectancy

http://krugman.blogs.nytimes.com/

Most of the increase in life expectancy is due to reducing early deaths

Life expectancy at 65 has barely moved for poor people

15 years in 1986 to 16 years in 2006

One year - then eliminated by the increase in retirement age

- THAT WAS NOT THE - POOR PEOPLE - THAT WAS THE BOTTOM HALF!!

Even for the well off

16 years in 1986 to 21 years in 2006

A significant change - but not a massive one

My take on retirement

It takes x man hours to run society, we are NOT using the available man hours (unemployment) - therefore removing man hours from the equation (early retirement) should lead to reduction in unemployment - WITHOUT reducing the available wealth

From this as long as we have unemployment early retirement does not reduce the total wealth

Most people don't simply vegetate when they retire - they do things - charity work - build hot rods - run local councils

I would much rather my society paid for the old duffers to potter about and gave their jobs to the young people who need them

This is reinforced by the fact that as I get older I have very little energy left after my working day to do all of the other things I want (or the wife wants me) to do

I like the "mad" European approach and I think that Dr Brin is mad for not liking it

I agree with Paul about the last few years being the "most destructive" - my parents went downhill very fast working in their sixties

David,

"Fine. Show me your plan."

First show me that the group you are targeting is in any way responsible for the thing you are trying to combat. US social security is a self-funded scheme, it didn't cause the US debt. Wages at the bottom of the market have not boomed due to labour shortages, they haven't grown in decades. The poor did not kill the US economy.

People who collect government pensions are not the people who have an extended lifespan. Nor have they gained from increase GDP, indeed, they've lost the gains they had made before the '80s. Why would anyone countenance betraying them yet further, and it is most definitely a betrayal. A sick joke on our own parents.

The people who have benefited, the people who have lowered their own tax burden, who have gained longer lives, who have increased their share of the national wealth, and who were responsible for the destruction of the economy, (both the GFC and the debt, which you know and have written about,) how about those people stop whining and pay their damn taxes.

The last election showed that you do not need to kiss up to these these spoiled, selfish, psychopathic monsters. So why the hell would we kick down at the people who haven't actually done anything wrong, to make some bargain with the people who have done everything wrong, a bargain they will never keep their end of, because they have no honour, and no shame. How many pension funds have been stripped? How many workers have sacrificed salary for some longer term benefit only to have the company renege on the deal? What did they do to the last deal to balance the budget, to pay down debt? How long did their word last? Why would anyone trust these assholes to keep their word now?

You even offer delayed retirement not as a way to actually solve economic problems in the US, which it won't, but as a token sacrifice to try to get the billionaires to agree to pay their damn taxes. A gimmick to pretend to buy into their mythology of "job creators" vs "lazy workers" enough to trick them into actually helping the economy.

And it's the same with European workers. It is not the "bennies" that destroyed the European economy. The blame lies solely with the structural problems of the Euro. And yet people who should know better, including you, have turned it into some moral-play about the good efficient Germans vs the lazy no-good Greeks/Spaniards. And the people who should know better are offering "solutions" that even their own theories say will make things worse, and their own numbers say have already made things worse. Why would European workers, who know they didn't cause the collapse, who know the solutions offered are worse than nothing (actually worse than doing nothing), why would they give up rights, rights, they fought for generations to get, just to appease the egos of the people who caused the damn crisis in the first place?

Along the same lines...

Carl M.,

Re: Flat tax.

Similarly, many of us don't trust that the change is intended to be non-regressive. Or that the top end of the income ladder wouldn't keep all their "bennies" while the bottom of the ladder loses progressivism.

(That said, I've always been partial to the idea of universal flat per-person payment replacing deductions and welfare. The maths doesn't work, but it's so damn elegant.)

And just to stop shouting...

Astronomers have discovered a free-flying "rogue" planet in a nearby (100lyr) star cluster.

http://www.bbc.co.uk/news/science-environment-20309762

From there point of view, it allows them to study the planet without the interfering light from a parent star. But what I find interesting...

The theory around rogue planets suggests that they are 50% more common than regular planets. So a) we just went yet another notch down the centre-of-the-universe scale, and b) that means there should be around 12 rogues between us and our neighbouring stars. Which, assuming a 3lyr average "halfway" to neighbouring stars, means the Oort cloud is about 1/8th the volume of our solar system's surrounding empty space. So at any given time, there will be 1 to 2 rogue planets passing through the Oort cloud.

Ah, arithmetic, it calms me...

Remember part of that increase in AVERAGE life expectancy has to do with decreased infant mortality, which means people don't live that much longer than they used to once they get past 60. At 60 now, I'm really happy I have a solid job at a stable company, because I would not want to be out looking for a new job at this age. I have friends who had to rely on Social Security way earlier than they had planned because they lost a tech job in their late 50's, could never get back into a stable one, and ate through all of that 401k money well before the SS checks started coming in. I'm well paid, my SS contribution caps out every year. I say raise the SS cap. I would only affect people who can afford it.

"I offered one... letting the employment after 65 be 25 hours a week mentoring and tutoring in schools, for example."

I like the idea of some kind of setup where someone past 65 could get paid for some part-time work in service of education. One friend in the hardship case I described above was volunteering reading to kids in the library and in schools the whole time he was unemployed. People would have loved to pay him, but nobody had any funds. But setting that up nationally might require some major Peace Corps/Conservation Corps kind of organization to put in place.

I agree with Paul51: "And it's the same with European workers. It is not the "bennies" that destroyed the European economy. The blame lies solely with the structural problems of the Euro."

We end up building systems where banks are guaranteed a profit, and everyone else has to tighten their belts, even when it was the banks that cause the problem. The Spanish government was doing just fine balancing their books, but the banks were lending money like crazy in a way that created a housing/property bubble for which the spanish people end up paying.

The system is set up so that we have to respect the rights of the banks, but the banks end up with no real responsibilities. Interest paid on a loan is a fee for the risk the lender is taking, if the banks aren't risking anything, they shouldn't be paid interest.

I don't have time to look at it now but historic data on welfare spending can be found here;

http://www.usgovernmentspending.com/download_single_year

DS McCoy,

"Remember part of that increase in AVERAGE life expectancy has to do with decreased infant mortality,"

The numbers quoted by Duncan are average life expectancy at 65. Ie, once you reach 65, how many years you have left on average. It specifically excludes the effects of infant mortality.

Ian,

Unless I'm using the system wrong, as a percentage of Federal spending and excluding healthcare, there's very little change in Pension and Welfare spending over the last 30 years. Likewise, as a percentage of GDP. (But I suspect this doesn't include the social security fund, which is, obviously, off-budget.)

David,

"that is not what all our ancestors did. They stayed useful till infirmity or dotage stopped them, because our job is to serve the next generation, whatever it takes."

Aside from my point that things should be better than our ancestors, otherwise what the hell were they working for... How do I benefit from having my parents worked to death? I don't have kids, but I know if I did, my parents (and their mother's parents) would be a huge resource to help raise them. But their utility in raising their grandchildren has already been vastly reduced by the damage done by those last 3-5 years of their working lives. Add another 5 years, and it would be eliminated entirely.

Going further: In the US, not only has income for the bottom half stalled for thirty years, but intergenerational mobility is lower than it was thirty years ago. The people who need government pensions are in the bottom 50% of income earners, and their grandchildren are increasingly likely to also be stuck in the bottom 50% of income earners. The grandchildren of the wealthy, otoh, are more likely to be similarly wealthy.

So you're asking people to shorten their already shorter lives even further (and make no mistake, if you raise the pension age, you are going to be killing people) in order to benefit the grandchildren of the wealthy, at the expense of their own grandchildren. For a plan that almost certainly won't help the US economy, and will be reneged on by the other side the moment they can get away with it.

No.

I think the tax scheme would be prone to overfit. The number of tax rules left at the end are your variables, you need substantially more data points (tax payers) than there are variables. You also need to tune on one set of data points and then test for correctness on another.

If you don't do these things then it will basically pick a tax rule for each of your hundred examples, set that to their current effective tax rate and zero the rest.

Dr Brin:

What I despise is what the Europeans have done, defining work as BAD and retirement as an unalloyed right to roam about doing whims for decades.

Coincidentally, Paul Krugman touched on THAT (although obliquely) in his blog as well:

There’s a strand of thought — I identify it especially with Corey Robin, although he’s not alone — that says that conservatism isn’t really about the things it claims to be about. It isn’t really about free markets and moral values; it’s about authority — the authority of bosses over workers, of men over women, of whites over Those People.

Doing something that contributes to society until I'm 80? I've got no problem with that. But "submitting to the authority of a boss, who can take it all away from me for any reason he darn well pleases" until I'm 80? That should not be a requirement of citizenship in these United States.

Larry said;

Doing something that contributes to society until I'm 80? I've got no problem with that. But "submitting to the authority of a boss, who can take it all away from me for any reason he darn well pleases" until I'm 80? That should not be a requirement of citizenship in these United States.

I'm not an American so the

who can take it all away from me for any reason he darn well pleases

Does not apply - he would need some reason -

But I'm getting fed up with somebody else deciding what I should do!

Being a grandparent/mentor/charity helper would all contribute - but none are paid

In my experience very few people would vegetate and sloth around - a ton of extra things would get done while the current jobs occupied by the early retirees would be taken by the unemployed youth

most of whom are not suited for the the grandparent/mentor/charity helper tasks that the elders would do

Society as a whole would see a whole lot more done and the total wealth of society would increase

-Getting the youth into jobs would also reduce the crime rate - a not insignificant benefit

I suspect that the automated simplification proposal would fail, largely because one couldn't make it significantly simpler while still preserving the various tax benefits.

Some comment on how much simpler some other country's tax filings are, but that is because they (at least for the most part) just deal with tax. The US, on the other hand, has chosen to pile all manner of other policy concerns into the tax code. Instead of choosing to fund some proposal directly, it is added as a tax deduction.

An alternative simplification proposal: make the tax code about taxes, and nothing else. Take all of the extras out of the tax code and operate them independently. If you wish to support home ownership by giving credits for mortgage interest, then have a program by which homeowners can apply for mortgage interest credits; if you wish to support "green" manufacturing, then have a program by which business can apply for credits for their "green" practices.

In addition to massively simplifying the tax code, this has the additional benefit of giving more clarity to the costs and benefits of the policy-driven credits.

The problem with your proposal David is that people are risk-averse and are unlikely to accept the results of a computer program showing them they'll be better off.

It's entirely likely too that the program will generate some counter-intuitive results (e.g. a lower tax rate on the middle class than the poor offset by elimination of tax breaks primarily used by the middle class)and people who wish to undermine the process (or simply to score politcal points) will seize on those counterintuitive examples.

Really, you're only likely to get soemthing liek this throufg if

a. you have biaprtisan support; and

b. you have something along the lines of a policy jury or consitutional conventional dominated by "people like us".

c. you'll almost definitely find multiple solutions (near-enough if not perfect) - so offer people a choice between them in a referendum.

Also, Mark Thoma reposted yesterday on the issue of Social Security: The Costs and Benefits of Raising the Retirement Age. Some of the comments are worth reading, as well.

A difficulty with your tax simplification idea, every complex bit in the current code was paid for, oops, suggested by a nice person, making a perfectly legitimate campaign contribution. Each of these would fight for the preservation of their favorite loophole. Funny how their dedication to small government wavers when it's their bottom line. I think your idea would help a lot, if it could survive, not only that, but the United States should strive to have the simplest, most straightforwards paperwork in the world, that accomplishes the intent of the law.

Paul451:

Using my parents as an example: in my opinion, they barely made it to 65. Their health just wasn't up to continuing. Another 5 years would have killed them. They are not "indolent", they can't do the things they dreamed about, even the simple things they can afford, because they can't travel long distances, can't walk much, can't risk being too far away from medical care. If anything, they seem trapped in their home. That's their reward for working every year of their adult (and much of their teen) lives. It's just cruel. People shouldn't be forced to work until they are too broken to continue. For fucks sake, David, things should be getting better. We shouldn't be going backwards.

I've been trying to say that as well. My own father was an optometrist and worked as such until into his 70s. Not rich, but certainly comfortable, and not the kind of labor that only the young can do. But when diabetes and dementia struck, he couldn't have any kind of retirement. No travel or anything like that--just slow deterioration in nursing homes.

If I could go back in time, I'd implore him to retire at 65 and enjoy some years with my mom.

Musical chairs indeed. I find myself coming to the defense of Brin, and about to say some things that will sound uncaring.

Firstly I am not at all surprised that a topic which started on tax increases quickly morphed to entitlements (aka spending). They are inseparable. Sure we can try to increase revenues, under whatever guise you need to get some R votes. This is essentially putting a surcharge on the tickets of the passengers in First Class. (Ooops, also Second Class with ocean view). It will no doubt provide somewhat better breakfasts for the folks down in steerage.

But we are still all traveling on the RMS Titanic, and just summarily dismissed Lt.Ryan, who kept telling us there was an iceberg ahead.

Seeing the passions released here by mostly reasonable people, I say again, I do not see the current admin pulling off meaningful reforms.

Regards life expectancy at 65.

We are pushing against the limits of biology. You see a few folks still vital and productive at 85. Damn few. We can fix worn out joints and such, but treating dementia is over the horizon, and there is an annual loss of things like lung function and renal function that either can't be changed or can only be managed at exponentially increasing expense.

As to the difference in life expectancy at 65 between the richest and poorest 50%...

1.It is possible that some of them are in the lower 50% due to existing poor health.

2.It is certain that some of the shorter life expectancy is due to poor personal choices. You smoke, you drink to excess (or even spurn that one crucial beer/wine per day!) you are not going to live long and prosper. In a free society we can't make people not do these things. So this discrepancy is durable.

3.There is a class of in between stuff. Obesity is part choice, part genetics, part our modern sedentary lifestyle. The second factor is not currently changeable. The other two only a little.

I wonder if being a parent is part of the perspective skew here. I would much rather give my kids a better shot in life than be kept in somewhat grander style at 90 when I no longer care.

Two final thoughts.

Conservatives are all about equality of opportunity, with no guarantee on equality of outcome. This is what we are discussing here.

The only person here who gets to create Utopias is David. It is easy for him (on paper). We lesser ones who have to work in the real world are not going to pull it off. (although making things incrementally better is our attainable duty)

Tacitus

Actually, I can also create utopias (on paper). It's just more amusing to show (on paper) that those utopias are on the surface only - that the graceful and beautiful swan is paddling like anything under the surface. ;) Actually, I suppose the one real thing my own attempts at stories show is that even if we had superpowers or magical abilities... things wouldn't be all that different now. And in fact they might be worse.

-------

My father has stated he's worked harder since he retired than he did for all the years he worked at the GE. Mind you, he got that early retirement (as did my mom for different reasons - losing your job in your late 50s will do that when you've worked in the administrative field all your life), but in his case it was planned... and he's been living comfortably. And now that he's heading toward 70, I can see the decline (physically). It makes me regret that I can't find anyone to settle down with me to give them the grandchildren they want before they're too old to enjoy them. :/

That said... I think Social Security should be revised to allow people to be employed part-time (or for X amount of money more likely). My reasoning is this: enforced idleness isn't healthy for people. Those older people who have an active social life and many activities are those who do the best. By allowing people to work past retirement should they so choose while still getting supplements from Social Security and Medicare benefits (if not on work insurance), you allow these people to remain active... and happier as a result.

And I will say, I think my grandfather (who died in his early 70s) was far happier as he was active during his older years than my great grandmother in her late 80s (don't remember if she surpassed 90, though I think she did) where she was living in an apartment (next door to my grandfather who'd visit daily and help out!) on the second floor and had no real social life that I could tell.

But then, my own memory was shot when I was 20, so given that was 20 years ago, I might not be remembering that accurately.

Rob H.

Annual operating cost should have been annual operating expenses. This is the number that is subtracted from operating income to arrive at the net income that is subject to tax. By specifying a multiple of this, a company can reserve some number of years of operating capital for lean years.

Tacitus said...

"Conservatives are all about equality of opportunity, with no guarantee on equality of outcome. This is what we are discussing here."

I would challenge that on Estate or Death Taxes...

Many Conservatives would say that Taxes are a limiting factor on opportunity. One can do less with with less. Generally, an individual will get the benefits from an Estate in their middle+ years. Suppose we had a tax burden shift (0 Net) from the early years of employment (20-30s) to the middle years (30s-50s) in the form of Estate Taxation.

This should give people more equality of opportunity. (The ability to apply more of their wages towards saving/investment.) Estate windfalls are very clear example of unequal outcomes regardless of personal virtue.

Actually, it is possible to make a certain amount of money on Social Security without losing your benefits. One of my jobs was driving for an auto auction house in California, picking cars up and driving them to the auction, and driving cars from the auction to the car dealerships that bought them. (Nobody's sending a big ol' semi to pick up two or three used cars, after all...)

Most of the drivers there were older, on Social Security, and kept very careful track of their hours so they wouldn't make too much money and lose their retirement funding. (My father was one of them.) As a younger driver, I was able to work a lot of overtime picking up their slack. (Sometimes it was less voluntary - when you get into a car in Huntington Beach at 4:20pm and start heading to Oceanside, you're not going to get there before 5...)

I would like to see the tax code reformed so that we could afford universal health care - as an almost-50-year-old with Asperger's syndrome, I find that I seem to be regarded as completely unemployable, yet still don't qualify for any government programs because my disability isn't physical or treatable. At the moment, I just try very hard not to get sick or become injured (I still owe various groups about ten grand for breaking my arm a few years ago...)

Thanks Tacitus. (And I giggle a bit about the tizzy that my post-election poke has roused; though honestly, it was an aside to my main point!)

I will take issue with this remark of yours: " Conservatives are all about equality of opportunity, with no guarantee on equality of outcome."

That is what YOUR conservatism is about, my friend. It is what conservatism should be about. It would mean that the right would have a criterion for picking wich liberal interventions to ferociously oppose, and which ones to merely criticize and improve through negotiation.

The simple criteria of:

1) might the intervention actually work as intended, markedly better than proposed private alternatives, without disastrous side effects and with a deadline for re-evaluation later?

2) Does the intervention aim to maximize fecund-productive competition by increasing the supply of ready, able and confident young competitors at the starting blocks?

3) Does it preserve a bounteous reward system to help propel that competition and eschew meddling overmuch with "outcomes..." while preserving a general sense of compassion and preventing the historically relentless failure mode of conniving oligarchy?

Under those two criteria, conservatism would keep faith with its positive side - Adam Smith, Alexander Hamilton, Bill Gates - while abandoning the shrill lunatic side - Rand, Norquist, Murdoch.

Show me THAT conservatism and I will be delighted hop with agility back and forth across every issue! Defying labels and irritating every partisan I know!

I'll even grant that conservatism protectorship over Christmas and the Flag (though I will never, ever allow a good olo boy to lecture me about patriotism, after he yammers about secession.)

I should say the tax on liquid assets is for corporations. I have some thoughts on individual taxes too, but not necessarily an asset tax.

I rather like the idea about making the tax code far simpler (thanks Greg B!), with taxes being just taxes, and tax breaks coming via application for programs. The tricky part will be deciding how much to allocate for people and businesses applying for those break programs, and you will still need government employees (probably those same tax officials!) to process the applications.

Entitlement has become a corrupted term, with a lot of baggage and bad press. It used to mean a promised service or good that was rendered because of previous payments, either overt or rolled into another heading, to which you were entitled. It needs to be reclaimed or replaced.

TheMadLibrarian

535 Askinly: a lot of questions

One thing does trouble me -- and granted, I'm probably being overly cynical (or paranoid) -- but it seems to me the last time Congress set aside their differences in the face of an overwhelming crisis and acted as one in the spirit of true bipartisanship, we wound up with the PATRIOT Act.

David

with but minor changes in wording all those criteria could in theory be applied to public sector programs.

do they work as intended, are there undesirable side effects, when do we re-assess and how, are they demonstrably superior to private sector programs...

Of course if you dare question the cost effectiveness of the VA medical system (better care and cheaper if folded into private system) or if you look at whether Headstart programs have a statistically significant improvement in later educational attainment, or if you God forbid question the merits of Sesame Street...

Well, you are just a big ol' meanie who better shield his online persona a lot better than I do. 'Cause your gonna wake up some morning with picketers at your front door and the severed head of Oscar the Grouch in your bed.

Tacitus

Actually, I would not mind moving a number of government agencies into the NONprofit sector. Think about it: for-profit businesses look for methods of maximizing profit, which may run contrary to some government agencies. But nonprofit businesses are more concerned with their mission rather than profit. And they are increasingly adopting business practices from the for-profit sector as the increased efficiency increases the ability of the nonprofit to meet its goals.

Rob H.

So... this mathematical model of our revenues... where is it described and how do we get a copy of it? I'm sure plenty of amateurs have the iron necessary to run it and explore the 'no losers' solution space.

Tacitus2:

Musical chairs indeed. I find myself coming to the defense of Brin,

That's one good thing about this "place". Everyone isn't a predictable robot who will comedically say the same thing ever time.

I mean that as a compliment. :)

Firstly I am not at all surprised that a topic which started on tax increases quickly morphed to entitlements (aka spending). They are inseparable.

When someone insists that reducing spending requires cutting Social Security benefits, I do feel compelled to ask what the connection is. If Social Security saves money, that money is in the SS trust fund, not the Treasury. The only way cutting SS saves money for the Treasury is if the Treasury gets forgiven the "loans" it took from SS.

So while I do agree that deficit reduction requires spending cuts, I honestly don't see how Social Security enters into the equation except as a red herring.

But we are still all traveling on the RMS Titanic, and just summarily dismissed Lt.Ryan, who kept telling us there was an iceberg ahead.

Again, a difference in perspective. I'm sure you state what seems to you self-evident truth. To me, though, Lt Ryan keeps insisting that in order to avoid running into the iceberg ahead, we have to scuttle the boat. Instead of steering away or reversing engines. "We've got to sink the boat before it's too late!"

Oh God... you folks should see this:

http://www.motherjones.com/mojo/2012/11/georgia-senate-gets-52-minute-briefing-united-nations-takeover

http://www.motherjones.com/mojo/2012/11/

georgia-senate-gets-52-minute-briefing-

united-nations-takeover

"Of course if you dare question the cost effectiveness of the VA medical system (better care and cheaper if folded into private system) or if you look at whether Headstart programs have a statistically significant improvement in later educational attainment, or if you God forbid question the merits of Sesame Street..."

Grouchy... but spoken as a conservative whose constructive criticisms are aimed at pragmatic ends.

No compare yourself to the folks who run the party, cited above.

On the Mother Jones thing...

A while back, they tried to equate President Obama with the evil alien reptiles from "V".

Now it sounds as if they think he's one of the Gubru from "The Uplift War".

:)

Tacitus2:

Of course if you dare question the cost effectiveness of the VA medical system (better care and cheaper if folded into private system) or if you look at whether Headstart programs have a statistically significant improvement in later educational attainment, or if you God forbid question the merits of Sesame Street...

From someone who dares question the infallibility of supply-side theory, who disagrees with the proposition that Ronald Reagan is our greatest president ever, and who asserts that the United States of America was not founded as a Christian Nation, I feel your pain.

Grouchy? Moi?

Nay, sir. I am the merriest of philosopher-serfs.

Some of the people who ought to be grouchy are vets waiting too long for mediocre care, and worse still, parents who have no option but to send their children to mediocre schools.

It is noble and worthy to criticize the private sector. Venal and base to do so of our public servants.

Tacitus

I just spoke with several medical professionals who rated the VA very highly compared to other medical systems in which 70% of the attention goes to billing. Squint and picture a better -funded VA. Is it possible that with more ombundsmen and nurses and physical therapists, it might actually work?

I ... am... ignorant and curious about this and (rarely for me) actually humble. I will heed and weigh words from Your Grouchiness.

Speaking of grouchiness...

I realize now that I was yesterday and am still currently coming down with a cold from my daughter.

So...my questions and answers are genuine, but my mood and tone may be a bit off.

Caveat emptor.

Tacitus2:

It is noble and worthy to criticize the private sector. Venal and base to do so of our public servants.

Is that the impression you're getting from the media and/or public discourse?

I feel as if I've been hearing the exact opposite treated as gospel, even in what gets maligned as the "liberal media", for at least a decade if not three. That government workers are greedy leeches, but the private sector by definition knows how to get things done, and so may not be questioned.

From previous thread

We are descended from the herems of men who reaped sexual-repro rewards for achieving power.

From this thread

Our ancestors did not get "retirement".

Well, the if we go back in our lineage to those harem owners it looks to me like those ancestors did get retirement, at least a life of more luxury and less labor than their contemporaries. Between then and not so long ago, many branch-points of our human family tree have also gotten retirement (kings, bankers, landowners, nabobs, Fortune 500 CEO's, etc.), after or while retaining the ability to provide for that part of the next generation who were their direct descendants.

What I despise is what the Europeans have done, defining work as BAD and retirement as an unalloyed right to roam about doing whims for decades.

Alternately, you could say that Europeans have defined labor as honorable and worthy of deferred compensation, something like the USA has done with Social Security.

Maybe the Europeans give the proles too much...maybe the USA too little.

And I know lots of Americans who do that too.

Retired people roaming about spend the same currencies as workers, and to the extent that they buy goods and/or pay for services, they strengthen an economy more and better than your and Adam Smith's rent-seeking moguls.

And sorry, that is not what all our ancestors did.

To some extent, for better or worse, many of us are destined to "turn into our parents", but we are generally not required to conquer other peoples' territory for food, and, although it still thrives in a number of areas, slavery is illegal worldwide. Many things our ancestors used to do would have a negative evolutionary impact if we were to emulate them today (burning witches, involuntary human sacrifice, honor killings of women, etc.).

They stayed useful till infirmity or dotage stopped them, because our job is to serve the next generation, whatever it takes.

You champion the concept of not viewing things as a zero-sum game, but from the above statement I get the idea that there isn't enough wealth to provide for people of retirement age (aka grandparents) as well as their grandchildren (who wouldn't be the next generation, that label applying to the parents of those grandchildren...parents who are generally working).

Considering the abysmal public school education many of these grandkids receive before they are loaded down with educational loans taken out in pursuit of disappearing jobs, clearly we can do better by them. But saying that the only way to do better by them is to reduce the amount of money in their grandparents' or parents' accounts in an attempt to persuade rent-seekers to lower their incomes a little seems like a simplistic and optimistic approach.

All right, I penned a response to the New Secession movement. It is snarky! In fact, I release it for some of you to post ANONYMOUSLY under a pen name. I know the diligent will be able to trace it to me and I don't mind a bit. I'd just rather the snark not be tied directly to my status as a public figure:

==

All the recent immature and silly talk of “secession from the United States can and should be mostly ignored. It is drivel spewed by one ten thousandth of a percent. Indeed, most of the liberal responses have been pretty darned puerile too. Like suggesting (self) deportation.

Still, the New Secession Movement merits a response and I suggest this one:

"You foolish fellows won't get to secede. Your states are net recipients of tax largesse from blue America and would collapse without us, so you’re bluffing.

“What you *have* accomplished with all this secession-yattering is to proclaim loudly: 'Us good ol boys are a bunch of sore-losers who never meant it when we waved flags and screamed Yew-Hess-Hay! Except for those of us who volunteered for military service.'

“And let’s pause to note that big exception: we HONOR you guys who did enlist and we avow that enlistment rates are impressive in red states. We promise we will put up with this sore-loser grumbling from YOU. Even if you insist on snarling about Blue State immorality. We who pay the taxes and have lower rates of teen sex, teen pregnancy, divorce, STDs, alcoholism, drug abuse and domestic violence... we’ll put up with such silliness from you redstate service members and vets; you’ve earned the right to scream ‘you kids get off my lawn!’ at us. We’ll just smile, ignore the absurd insults and pay your GI Bill with thanks.

“As for the rest of you whining sore-losers? The ones who haven’t served? Well, you can wallow in your fantasies about riding with Nathan Bedford Forest and holler about ‘secession’ all you like. Despite Fox, it’s still a free country.

“But you may never again lecture us about patriotism. Not ever again. We'll simply laugh in your faces while Blue America continues dragging you trogs into a bright, accomplished 21st Century, a world still led (despite you) by a scientific, broadminded, tomorrow-loving and dazzlingly successful United States.

“We’ll put up with your hypocrisy. That’s all that this 'secession' blather has accomplished for you - our smiling tolerance. Welcome to the future."

- Cincinnatus

At risk of moving the conversation back towards the original topic...

I'm pretty sure that your "100 sample taxpayers" is probably too small by at least an order of magnitude. And you've massively underestimated the complexity of actually modeling the tax system in software.

If we're going to handwave the complexity, I'd still rather start at the other end of the system - with actual tax returns. All of them. Parse them and digest it to determine the frequency with which rules are used (and magnitude as well).

If your goal is just to simplify the code, this approach would let you easily identify the low hanging fruit - rules that are used infrequently or which yield only tiny dividends.

But that simplification isn't really going to buy you much - it'll eliminate things that no one was using... making it look nicer, but won't accomplish much else.

The other problem is that the Tax Code is much more than just individual Income and Payroll Taxes - a lot of the complexity (I'd wager most, in fact) is on the corporate side, and a lot of those 10000 pages are dedicated to highly targeted tax subsidies such as the corn-ahol you mentioned. (Though my Googling seems to indicate that that particular subsidy actually died at the end of 2011)

...they strengthen an economy more and better than your and Adam Smith's rent-seeking moguls.

Only intended to put you in Adam Smith's camp, not in that of the rent-seekers.

I get that you reference them, not subscribe to them.

If The Tax Code is all 'officially coded' on a computer somewhere, seems like one of the tax prep software companies might want to generate some revenue for the guv'mint by paying a royalty to license it.

This is almost a 4 year old story from ABC, but it says what we have been hearing for decades...that given identical inputs, even the major tax accounting firms will not have identical results. If you could be *sure* that you owed $20,000 instead of $22,000,that seems like a marketable feature.

Hey, Mr. Gates...

http://abcnews.go.com/Technology/PCWorld/story?id=7081207#.UKVkKIbRaLE

Re: infanttyrone

... if we go back in our lineage to those harem owners it looks to me like those ancestors did get retirement, at least a life of more luxury and less labor than their contemporaries.

Well, there's quite a bit of difference between the concepts of "retirement" and "being wealthy" or "not having to work"...

Re-Life expectancy

http://krugman.blogs.nytimes.com/

Links to a story - I am over my limit so i can't read it -

That as a header has

Life expectancy for poor whites has dropped by 4 years since 1990

This idea that an increase in retirees is or will consume societies wealth appears to evaporate as we focus on it

Having disposed of that idea

I think we should look seriously at the idea that we should INCREASE the number of retirees

As I said earlier that would be revenue neutral as it would enable currently unemployed youngsters to do the retirees jobs and would result in a drop in crime and an increase in the amount of work actually done

Some people get old sooner than others. I saw lots of Mexican workers in clouds of silica dust as they used power saws cutting concrete blocks; but no worries, their future silicosis will be made to be non-refundable, much like people who worked for years at companies promising pensions suddenly find themselves with a fraction of the promise Those are the "takers,"it's only a momentary embarrassment that the Republicans ran a man for president who is directly responsible for that happening in many cases.

Long ago the drugstore sages nodded in agreement to the wisdom of the old saw that "if you redistributed all the money, in a few years the rich would have it all back." This is a trickle-up theory, however, so it's been put in cold storage for the time being. I believe it though.

Rick

Well, there's quite a bit of difference between the concepts of "retirement" and "being wealthy" or "not having to work"...

OK, clearly retirement doesn't necessarily involve being wealthy, especially these days.

But I'm curious what distinctions you make between retirement and not having to work.

After deciding that my ignorance about harems was inadequate, I've been reading a bit about the Ottoman Empire today.

Turns out that for a couple of centuries their unpaid cavalry, before they were made pretty much obsolete by firearms, were regularly rewarded with grants of land (parts of which might be vacant, while other parts might have villages and peasants working cultivated land).

They got to collect revenue from these lands for seven years, at which point the grant would be revoked unless they had performed military service within the preceding seven years.

So, a cavalryman nearing the end of his capability to serve effectively might go on one last campaign and then "retire", probably not wealthy by modern standards, but comfortable for his day. And even if he had blown through the revenue from his earlier periods of service on hash, taffy, and fine carpets, he would still have seven years to try to amass a pile large enough to support him in whatever time remained of his life.

Even if the wealthy Sultan could never escape the "work" of making executive decisions about his empire (and the work of checking his six on a regular basis), some of his military had a decent chance at what I suspect most people today would call retirement...until the guns showed up.

Regards the VA

I realize that this is a side question off of a side question.